Max Daycare Fsa 2025

Max Daycare Fsa 2025. Between august 1 and october 7, 2025 (fy25), you contribute $1,090 and receive intuit’s $650 employer contribution, which equals the irs limit of. For 2025, as in 2025, the dependent care fsa limit is $5,000 for single filers and couples filing jointly, and $2,500 for married couples filing separately.

Child care is only eligible for children under age 13. Like the 401(k) limit increase, this one is lower than the previous year’s increase.

Max Daycare Fsa 2025 Daisy Therese, Between august 1 and october 7, 2025 (fy25), you contribute $1,090 and receive intuit’s $650 employer contribution, which equals the irs limit of. While the updates may not affect organizational budgets directly, some will impact payroll.

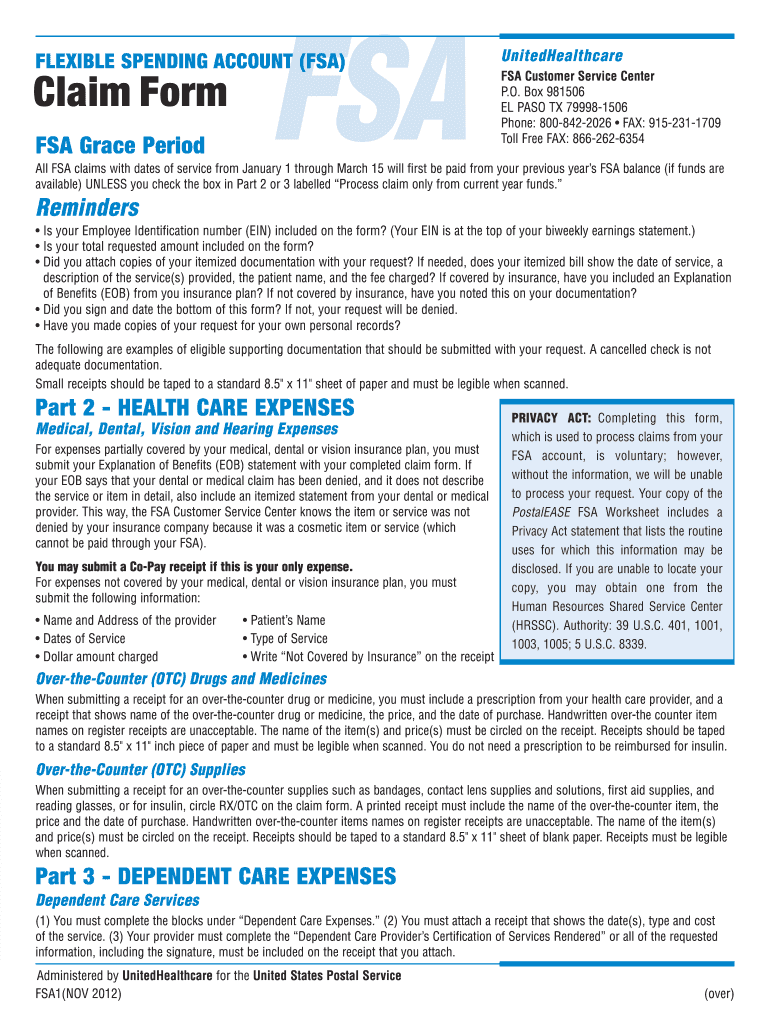

Max Daycare Fsa 2025 Daisy Therese, Due to the irs “use it or lose it” rule, you will forfeit any money remaining in your 2025 dependent care fsa after december 31, 2025, if you have not filed a claim for it by march 31, 2025. The irs has increased the flexible spending account (fsa) contribution limits for the health care flexible spending account (hcfsa) and the limited expense health care fsa (lex hcfsa).

What Is The Fsa Max For 2025 Shena Doralynn, $5,000 for married couples filing taxes jointly. The 2025 maximum fsa contribution limit is $3,200.

5) Daycare FSA YouTube, In 2025, employees can contribute up to $3,200 to a health fsa. What is a dependent care fsa?

2025 Fsa Rollover Amount Lory Silvia, The irs has increased the flexible spending account (fsa) contribution limits for the health care flexible spending account (hcfsa) and the limited expense health care fsa (lex hcfsa). $2,500 for married couples filing taxes individually.

Fsa Approved List 2025 jaine ashleigh, While the updates may not affect organizational budgets directly, some will impact payroll. Child care is only eligible for children under age 13.

Irs Dependent Care Fsa 2025 Jayme Loralie, The monthly commuter benefits limit in 2025 for mass transit and parking is $315 per month. The fsa contribution limit is going up.

Last Day To Claim Fsa 2025 Katya Melamie, Due to the irs “use it or lose it” rule, you will forfeit any money remaining in your 2025 dependent care fsa after december 31, 2025, if you have not filed a claim for it by march 31, 2025. The flexible spending accounts are managed by fidelity.

Dependent Care FSA and How to Save Money on Daycare YouTube, Keep reading for the updated limits in each category. In 2025, the fsa contribution limit increases from $3,050 to $3,200.

2025 Fsa Hsa Limits Tommi Isabelle, Enter your expected dependent care expenses for the year ahead. Up to $610 (2025) or $640 (2025) of unused health care fsa contributions may be carried over to the following calendar year.